Submission of simplified tax reporting on value added tax¶

The «Simplified tax return on VAT» section of the Non-resident – VAT payer office enables the user to form and submit:

- a simplified tax return on value added tax (hereinafter - «Tax Return»)

- a clarifying calculation of value added tax liabilities to the simplified tax return base on the correction of self-identified errors (hereinafter «Clarifying calculation»).

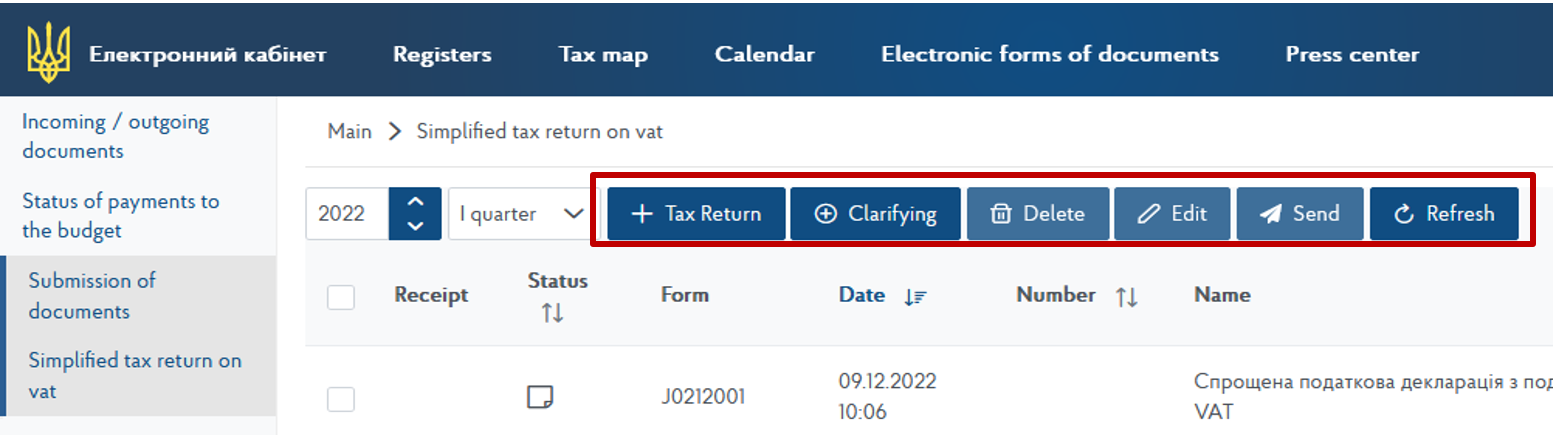

The «Simplified tax return on VAT» section contains buttons:

«Tax Return» - allows to create a Tax Return,

«Clarifying» - allows to create an Clarifying calculation,

«Delete» - allows to delete saved documents which were not sent to the controlling body,

«Edit» - allows to edit documents that were saved but not sent to the controlling body,

«Send» - allows to send the created document to the controlling body,

«Refresh» - updates the displayed data on the Non-resident – VAT payer office page.

To create a document:

Choose in the box year for which the document is submitted.

Choose in the box year for which the document is submitted.

Choose in the box  reporting (tax) period, for which the document is submitted.

reporting (tax) period, for which the document is submitted.

Create a document and fill in the appropriate form of simplified tax reporting on value added tax.

Filling in the Tax Return form

| Document line | Instructions |

|---|---|

| Name of a non-resident | filled in automatically, according to the credentials (no changes can be made) |

| Individual tax number of a non-resident registered as a taxpayer | filled in automatically, according to the credentials (no changes can be made) |

| Foreign currency (euro or US dollar) in which the tax is paid* | filled in automatically, according to the credentials (no changes can be made) |

| The contractual value of the supplied electronic services (without value added tax)** | the total amount (contract value) of the supplied electronic services (without VAT) in foreign currency (euro or US dollar) |

| Amount of value added tax payable to the budget** | calculated automatically (the amount of the field «Contractual value of the supplied electronic services (without value added tax)»** x 20%) (*with possibility to edit). *In case a non-resident applies a preferential tax regime (the supply of relevant services, which is exempt from VAT taxation), the user can adjust the automatically calculated amount in the line «Amount of value added tax payable to the budget**. |

After completing the form, the document should be saved.

Your letter is saved but not send to the recipient

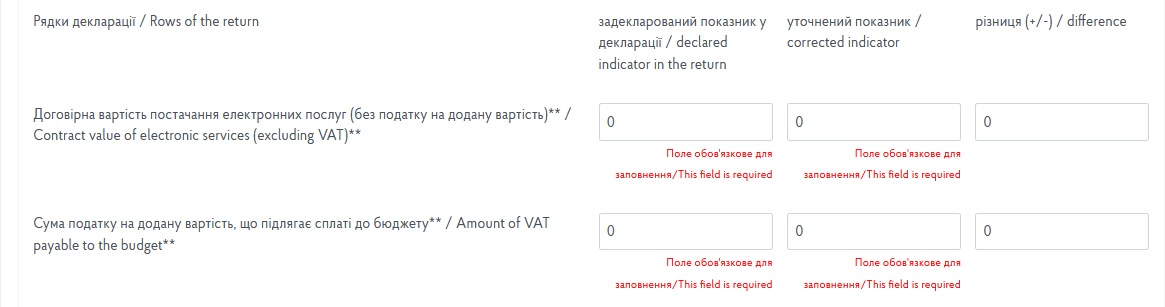

Filling out the Clarifying calculation form

| Document line | Instructions |

|---|---|

| Name of a non-resident | filled in automatically, according to the credentials (no changes can be made) |

| Individual tax number of a non-resident registered as a taxpayer | filled in automatically, according to the credentials (no changes can be made) |

| Foreign currency (euro or US dollar) in which the tax is paid* | filled in automatically, according to the credentials (no changes can be made) |

| The contractual value of the supplied electronic services (without value added tax)** | the «declared value in the return» column is filled in by the user and displays the corresponding return’s indicators for the reporting period that is being adjusted. If changes were previously made to the return for appropriate reporting period, the second column displays the corresponding indicators of the «adjusted indicator» column of the last clarifying calculation, which was submitted to the return for the reporting (tax) period that is being corrected; the «adjusted indicator» column is filled in by the user and displays the relevant indicators based on the correction; the «difference (+/-)» column is filled in automatically and reflects the difference (the «adjusted indicator» column minusthe «declared indicator in the return» column). |

| Amount of value added tax payable to the budget** | the «declared value in the return» column is filled in by the user and displays the corresponding indicators of the return for the reporting period that is being corrected. If changes were previously made to the return for appropriate reporting period, the second column displays the corresponding indicators of the «adjusted indicator» column of the last clarifying calculation, which was submitted to the return for the reporting (tax) period that is being corrected; the «adjusted indicator» column is filled in by the user and displays the relevant values taking into account the correction; the «difference (+/-)» column is filled in automatically and reflects the difference (the «adjusted indicator» column less the «declared indicator in the return» column). |

After completing the form, the document should be saved.

Your letter is saved but not send to the recipient

If there are errors in the completed form, such fields will be highlighted in color.

User should correct errors and save the document («Save» button).

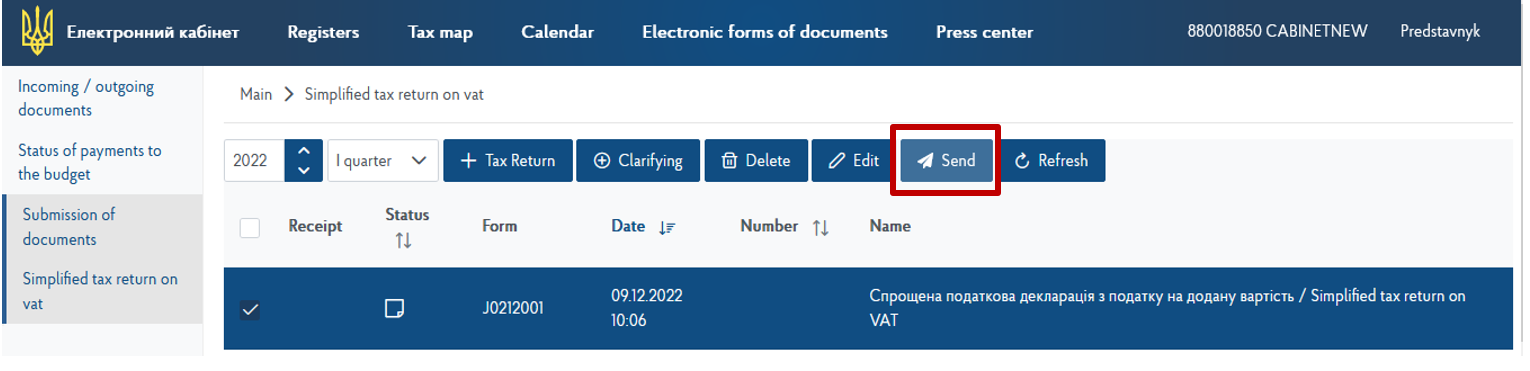

In order to send the document to the controlling body, select the created document and press the «Send» button.

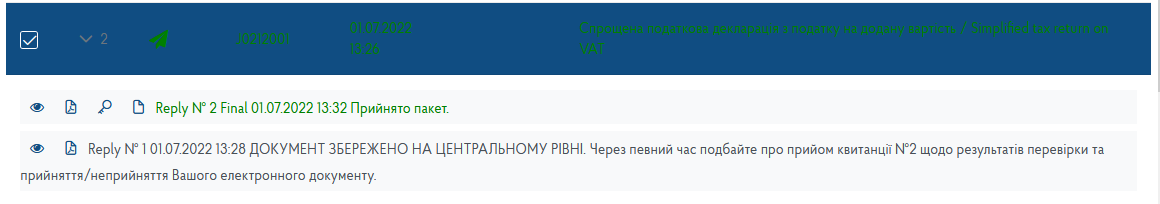

After sending the document, the user receives:

receipt (reply) № 1 – informs about the delivery of the document to the controlling body;

receipt (reply) № 2 - informs about the acceptance or non-acceptance of the document by the controlling body.

Receipt (reply) № 2 can be viewed and downloaded in pdf format in the «Inbox» section of the «Incoming/Outgoing Documents» menu.